A Biased View of Eb5 Immigrant Investor Program

Table of ContentsThe Greatest Guide To Eb5 Immigrant Investor ProgramSome Ideas on Eb5 Immigrant Investor Program You Should KnowUnknown Facts About Eb5 Immigrant Investor ProgramMore About Eb5 Immigrant Investor ProgramNot known Incorrect Statements About Eb5 Immigrant Investor Program All About Eb5 Immigrant Investor Program4 Easy Facts About Eb5 Immigrant Investor Program Shown10 Simple Techniques For Eb5 Immigrant Investor Program

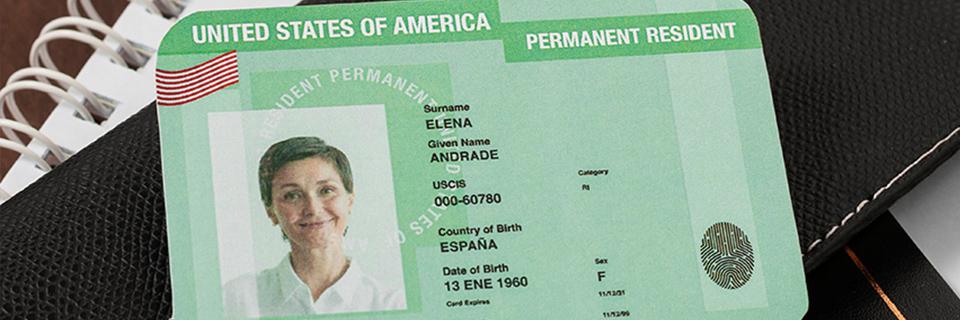

The investor has to use for conditional residency by submitting an I-485 application. This request must be submitted within six months of the I-526 authorization and need to include proof that the investment was made which it has developed at least 10 permanent tasks for U.S. employees. The USCIS will assess the I-485 application and either authorize it or demand extra proof.Within 90 days of the conditional residency expiry date, the financier has to send an I-829 petition to eliminate the problems on their residency. This application must include proof that the financial investment was continual and that it created at least 10 full time work for United state employees.

Eb5 Immigrant Investor Program Things To Know Before You Get This

dollar fair-market worth. The minimum amount of funding required for the EB-5 visa program may be decreased from $1,050,000 to $800,000 if the investment is made in a commercial entity that lies in a targeted employment location (TEA). To get approved for the TEA designation, the EB-5 job have to either remain in a backwoods or in an area that has high joblessness.

employees. These tasks have to be developed within the 2 year period after the investor has obtained their conditional irreversible residency. In many cases, -the financier should be able to confirm that their financial investment caused the development of direct work for workers who function straight within the commercial entity that obtained the financial investment.

The Of Eb5 Immigrant Investor Program

Regional focuses carry out EB-5 tasks. It might be extra helpful for an investor to purchase a regional center-run project since the investor will certainly not need to independently establish the EB-5 jobs. Mixture of 8500,000 as opposed to $1,050,000 is not as troublesome. Capitalist has more control over everyday procedures.

Capitalists do not require to produce 10 jobs, yet preserve 10 currently existing positions. Company is currently distressed; hence, the investor may negotiate for a far better offer.

Congress gives regional centers top priority, which can suggest a quicker path to approval for Form I-526. Investors do not need to develop 10 straight tasks, however his/her investment needs to develop either 10 straight or indirect work.

The financier needs to reveal the production of 10 tasks or potentially more than 10 tasks if increasing an existing company. Risky because business is situated in a TEA. Have to generally reside in the same location as the venture. If organization folds within two year duration, financier can shed all invested funding.

Facts About Eb5 Immigrant Investor Program Uncovered

Worsened by its location in a TEA, this business is already in distress. Need to typically stay in the very same place as the enterprise. If service folds up within 2 year duration, financier can lose all spent funding. Financier needs to show that his/her investment develops either 10 straight or indirect tasks.

Normally used a position as a Limited Liability Companion, so capitalist has no control over everyday operations. The general partners of the local center firm generally benefit from capitalists' investments. Financier has the option of spending in any kind of kind of enterprise throughout the united state May not be as risky since investment is not made in an area of high unemployment or distress.

See This Report on Eb5 Immigrant Investor Program

Congress offers local facilities leading concern, which might imply a quicker course to authorization for Type I-526. USCIS has yet to officially implement this. Financiers do not require to develop 10 straight work, however their financial investment must develop either 10 direct or indirect tasks. Regional Centers are already developed.

If business folds within 2 year duration, capitalist can lose all invested funding. The financier requires to reveal the development of 10 work or potentially more than 10 jobs if broadening an existing company.

The financier needs to keep 10 currently existing staff members for a duration of at least 2 years. If a financier likes to invest in a local center company, it might be much better to spend in one that just needs $800,000 in financial investment.

All About Eb5 Immigrant Investor Program

Financier requires to reveal that his/her financial investment develops either 10 straight or indirect jobs. The general partners of the regional center business normally profit from capitalists' financial investments.

The 45-Second Trick For Eb5 Immigrant Investor Program

residency. $5 million (paid to the united state government, not an organization). Unlike EB-5, Gold Card capitalists do not require to produce tasks. Trump has marketed this as a "Environment-friendly Card-plus" program, suggesting potential rewards past standard permanent residency. The program limited to 1 million Gold Cards globally. Comparable to EB-5, it might eventually bring about united stateworkers within 2 years of the immigrant financier's admission to the United States as a Conditional Permanent Local. For full details go to this web-site regarding the program, please check out. The investment demand of $1 million is reduced to $500,000 if an investment is made in a Targeted Work Area (TEA). In city areas, TEAs have to have a joblessness rate of at the very least 150% of the nationwide typical unemployment price.